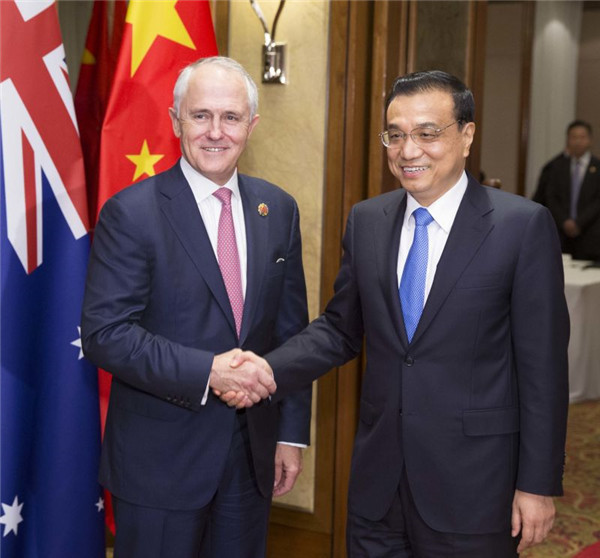

Chinese Premier Li Keqiang (right) shakes hands with Australian Prime Minister Malcolm Turnbull during their meeting on the sidelines of a series of regional summits in Kuala Lumpur, Malaysia, Nov 21,2015. (Photo/Xinhua)

In his 18-minute speech on Sunday formally announcing a double dissolution election on July 2, Australian Prime Minister Malcolm Turnbull highlighted his government had set the stage for strong trade with China and Asia.

The Australian leader obviously considers the free trade agreement with China, which was signed on June 17 last year and took effect on December 20, a valuable political asset for his coalition government.

His campaign, which has put its economic management at the forefront, will likely hold up the FTAs the ruling coalition has signed with China, Japan and South Korea since winning the election in 2013 as good business for Australia.

The China-Australia FTA agreement is widely perceived as a game-changer in bilateral trade, which will contribute to meaningful bilateral interaction and to the larger picture of economic integration in the Asia-Pacific as well.

It opens new horizons for China-Australia trade and economic ties and enables it to emerge from the previous growth pattern that was largely driven by China's demand for Australian minerals and other natural resources.

Only four months after the implementation of the FTA agreement, people on both sides have already seen a lot of changes brought about by the new arrangement. Chinese, for instance, now find themselves enjoying a much wider range of products from Australia, including farm produce, dairy foods, seafood, wines, and health products.

Australia is also becoming a hot destination for Chinese tourists traveling abroad. According to the Australian Bureau of Statistics, in the 12 months to March, arrivals from the Chinese mainland and Hong Kong outnumbered New Zealanders, the first time Australia's biggest neighbor has lost the top spot in the history of the survey, which dates back to 1991.

And the property markets in Australian cities such as Sydney and Melbourne are heating up thanks to the zeal and zest of Chinese property investors. According to China's largest international real estate property portal, Juwai.com, Chinese buyers made 61 per cent more inquiries about Australian property in the first quarter of this year than the same period last year.

All these changes may not have a direct connection with the China-Australia FTA. But the influx of China's investors and the growing penchant of Chinese consumers for Australian goods and services are certainly good news for the Australian economy. Earlier this month, Australian Minister for Trade and Investment Steven Ciobo said the bilateral FTA agreement is "delivering" for Australian businesses, as the Chinese appetite for premium Australian products such as wine, beef, seafood and vegetables had contributed to a number of impressive gains in export levels.

He said the reduction and abolition of tariffs on agricultural products had led to a big increase in export requests from China, which he said was greatly benefiting Australian businesses and would continue to do so for "years to come".

But while the FTA has served as a stabilizer for bilateral interaction and is encouraging more and more Australia-bound Chinese investors and tourists, more still needs to be done.

Chinese investors need to know they will face a level playing field in Australia instead of differentiated treatment. So far, under Australia's foreign investment regime, China is the most closely scrutinized among Australia's foreign trade partners.

Some in Australia now seem to have a love hate dilemma about Chinese investors, especially those flocking to the country's property market.

These people should have confidence in their country's laws and regulations which encourage proper business behavior from foreign investors.

In a sense, the China-Australia FTA, a marriage between the world's second-largest economy and a major Western economy, is a test that both countries need to pass with high marks in return for the efforts that went into securing it and the aspirations both sides have for the future of their economic and trade relations.

The author Wang Hui is deputy editor-in-chief of China Daily Asia Pacific.

《土樓回響》在澳洲掀起文化熱浪

《土樓回響》在澳洲掀起文化熱浪 【走進內閣】認識澳大利亞最高級別的政府官員(一)

【走進內閣】認識澳大利亞最高級別的政府官員(一) 【90后看大佬】 “僑送光明,醫濟僑胞,借船出海”——澳洲康平國際醫療集團總裁陳星惠醫生專訪

【90后看大佬】 “僑送光明,醫濟僑胞,借船出海”——澳洲康平國際醫療集團總裁陳星惠醫生專訪 【90后看大佬】林輝源的“三不人生”

【90后看大佬】林輝源的“三不人生” 福建省僑辦領導會見東南網澳大利亞站代表團

福建省僑辦領導會見東南網澳大利亞站代表團 【90后看大佬】“左右合并”的幸福人生——澳洲潮州同鄉會會長李國興

【90后看大佬】“左右合并”的幸福人生——澳洲潮州同鄉會會長李國興 澳大利亞5名男子欲乘船離境加入“伊斯蘭國”被捕

澳大利亞5名男子欲乘船離境加入“伊斯蘭國”被捕 張高麗:加強全球稅收合作 推動世界經濟發展

張高麗:加強全球稅收合作 推動世界經濟發展 中華神盾艦與外軍聯演不帶翻譯 官兵英語交流

中華神盾艦與外軍聯演不帶翻譯 官兵英語交流 China warns U.S. against shows of strength in South China Sea

China warns U.S. against shows of strength in South China Sea Aussie dollar rides higher on global equities, oil

Aussie dollar rides higher on global equities, oil 澳大利亞非銀行貸方暫停放貸 海外借貸人寸步難行

澳大利亞非銀行貸方暫停放貸 海外借貸人寸步難行